Analyzing your Chime Bank Statement each and every month can definitely help you record and manage your expenses and spending.

In this article, you will get to learn about bank statement and how you can use them to make exclusive financial conclusions.

How to get Chime Bank statement on a Mobile Phone?

In this, you will get to know about the steps to get Chime bank statements on a mobile device.

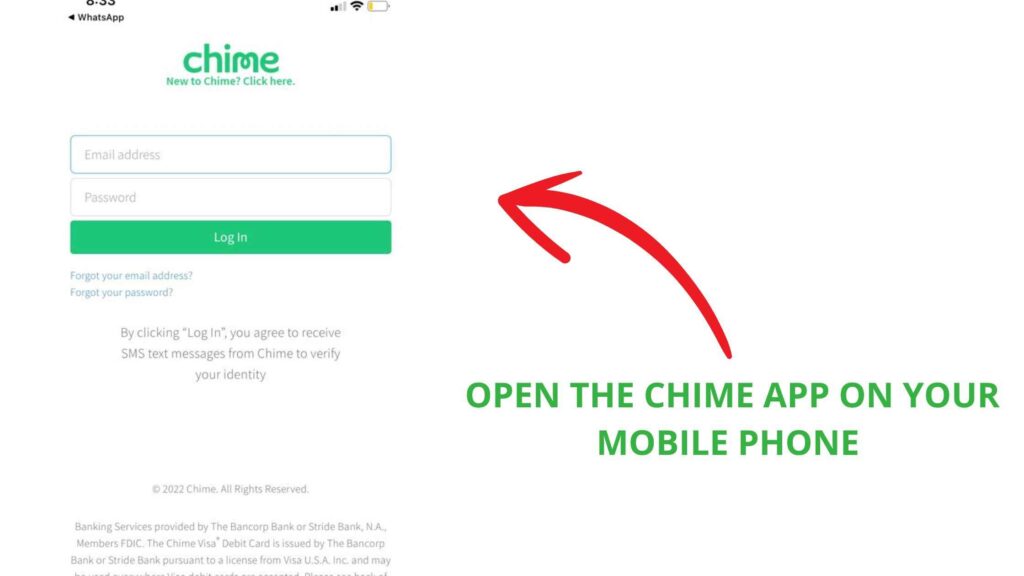

- Firstly open the Chime app on your mobile device. There you can download the statement easily on either Android or iOS, step will be the same.

Also, for your information update your Chime app once before proceeding to the next step.

- Now, select the settings icon as shown in the image below at the top left corner.

- Choose view Statement option :

You have to now select the view statement option, on the settings page.

Scroll down a little to find the option, you will find it at the bottom of the settings page.

Select the ‘view statement’ option to proceed.

- Next, select your account type either Savings account or Spending account as per your preference.

Chime unquestionably permits you to view bank statements of the account independently. You need to select one of the accounts to proceed.

For this, you have to tap on the account type on the top of the same page.

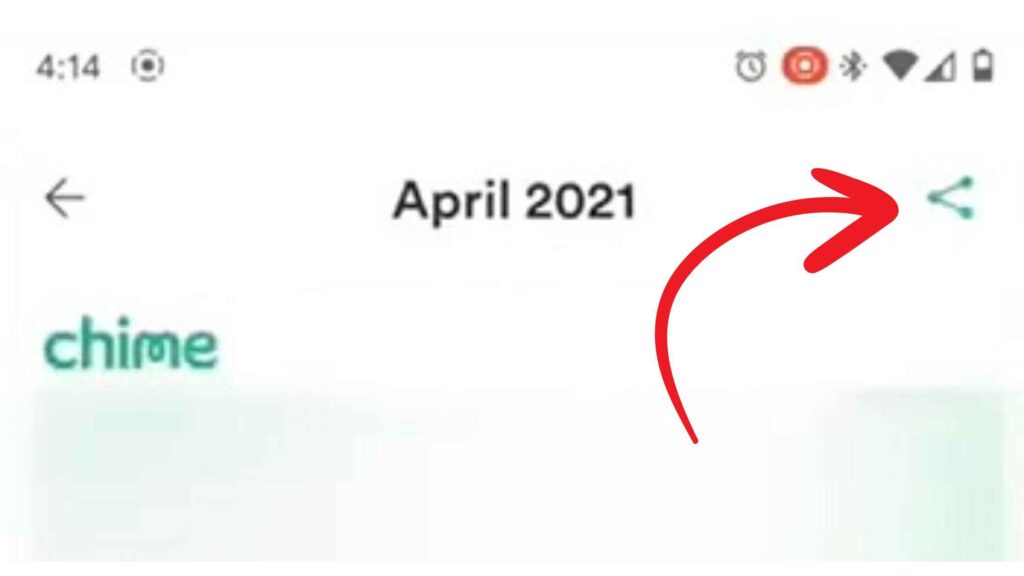

- Choose the month :

Select the month after selecting the account type. Pick the month in which you wish to check out the bank statements.

By selecting the month, you will be able to easily keep a track related to transactions made in the Chime bank account.

- Finally, download the file :

You will get an option to share the bank statement file with anyone else in your contacts. You will be able to share the file through different social media apps.

Click on ‘share’ button.

Then, select share button and choose Google Drive from the list to save it in your Google Drive cloud storage.

For downloading the file on your mobile, click on share button.

Then, scroll down the list a little, you will get the save on this option. Finally, select the option and you will be in a position to access the file anytime.

How to get Chime Bank statement on a PC?

To get the bank statement on PC kindly follow below mentioned points:

- Visit the official website of Chime.

- Click on ‘Log in‘ to go further.

- Sign in with the account :

Go to the signing page. Enter all your Chime account credentials. ( enter the correct details )

Note: If in case you enter the wrong password more than 3 times, you will not be able to access it for a while. ( you will be blocked for sometime )

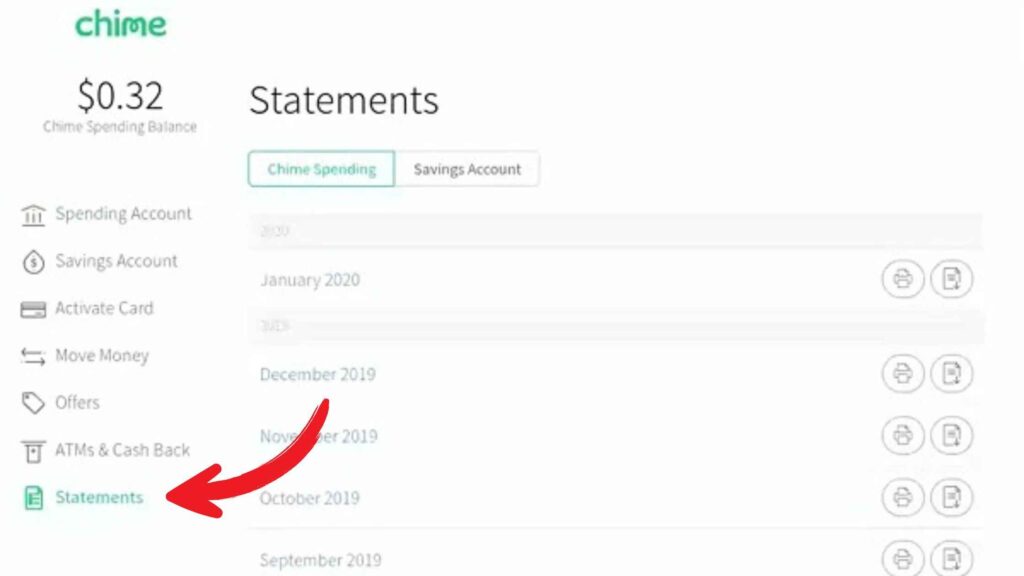

- Choose Statement option :

You will see the ‘statements’ option on the left side of the same page. It will be visible above the ‘Support’ option.

- Select account type :

Further, you have to choose your account type. If you wish to check the back statement for your ‘spending account’, select it from the tab on the same page.

- Select the month :

Chime maintains all the statement record of the past month. You may select one the month of which you ought to check the records.

- Finally, download the PDF :

To download, select the download icon. If you are making a use of Chrome browser, you will find the download icon in the top bar.

What is a Bank Statement ?

A bank statement is a chronicle that sums up all the transactions that took place in your bank account over a duration of a month.

The main motive of a bank statement is to note and track all your banking activities. It will be completely beneficial for you because this is how you can monitor all the money that is coming in and out of your account.

It’s necessary for you to repeatedly review your bank statements so that you can better understand your finances and probably detect any issues or unjustified charges on your account.

Bank statements are important. Also, the monthly bank statement date can be utilised to look over all your earnings as well as spending, you can manage them accordingly.

Not only this, you can easily access the bank statement of the Chime bank account. You can download a soft copy of your bank statements as well as you can share the file with anybody or save it on your device to interpret it afterwards.

How to read a Bank statement?

Reading a bank statement is not at all a tough task, but it’s important for you to completely understand about the information included in a statement and why that information is considerable when it comes to managing your finances.

Generally, bank statements carries the following information-

- Total withdrawals:

Bank statement will lay out your total amount of withdrawals in a month along with your purchases, ATM withdrawals, transfers, bank fee, etc.

- Total deposits:

Maximum bank statements set all the deposits together. They give you a total information about everything that came into your bank that month. Deposits include things like – transfers received, direct deposit, interest earned, etc.

- Balance summary:

This includes your account balance at the beginning of the month. Also, it will show your ending account balance after all of the deposits are added, moreover, the withdrawals are deducted.

Other things include –

- Individual transactions

- Bank contact information

- Personal identifying information

- Statement date

- Account type

What are the important things you should do with your Bank Statement?

There are several important things you should do with your bank statement:

- Integrate your account:

While reconciling your bank account, review your bank statement to make sure all information and transactions are correct. Reconciling your account can help you avert overdraft fees if in case your bank statement tells that you have limited money in your account than you were thinking you have.

- Analyse your saving and spending habits:

If you want to check any errors, analysing your bank statement is a good way. If you review your bank statement, you can also keep a record of your savings.

You can review your starting and ending balance. Then, observer how much you are spending as well as how much you are saving. This is how you will get to know that where your majority of the money is going.

Moreover, you will get to know how much interest you’re earning.

- File your records:

After analyzing your bank statement, file it in a safe place so that you can have a track of it. Also, you can download them or print them. Make sure to keep them safely.

How to convert Chime Bank Statement PDF to Word online ?

If you people wish to convert your Chime bank statement PDF to Word online then open PDF Simpli at first and then follow the below mentioned steps –

- Step 1 ( Add File ) – Choose a PDF file to upload

- Step 2 ( Edit ) – Now, you can edit your file

- Step 3 ( Convert ) – Tap on ‘Convert’ in order to change your PDF to Word

- Step 4 ( Download ) – At last you can download, save or print your file accordingly

If in case you people don’t want to use PDF Simpli, you can use directly open PDF in Microsoft Word and edit the same.

How to edit Chime Bank Statement PDF in Microsoft Word?

If you are using a latest version of Microsoft Word, simply “Right Click” on the PDF file and click “Open With” and select Microsoft Word.

Similarly once you save the changes you can resave the file in PDF. Simply click on “File” and click “Save As” now enter the file name and in “Save as type” select PDF.

How you can edit your Chime Bank Statement PDF?

If you wish to edit your Chime bank statement PDF online then firstly open Small PDF and follow the below mentioned steps-

- Firstly, drag and drop PDF document in the given PDF editor.

- Add shapes, text, images according to your wish.

- You may edit the font, size and color of the added content accordingly.

- Click on ‘Apply’ and save the changes.

- At last, simply download your edited PDF.

How can you check you Chime Account balance ?

You can easily check your Chime account balance in following ways as mentioned below:

Checking Chime balance through mobile App

You can easily check Chime balance, if you use Chime app on your mobile. For this, you need to open the Chime app either on iOS or on your Android device. The first that will be visible to you is your balance.

Whatever will be your Chime balance, it will be the total of the amount in the savings and spending account.

If in case you transfer funds from spending account to your Chime credit builder card, it won’t be counted as your Chime balance, because the amount will be subtracted when the date arrives.

Checking Chime balance through Website

In case you don’t have access to your mobile phone, you can use Chime website to check the balance. Make sure that your network is fine.

Visit the official website of Chime and keep your account credentials in your mind, add them when asked. Once the process is done, you can check your account balance. Total Balance will be visible on the left side of the screen.

Checking Chime balance through Chime in-app notifications

If you are already using Chime app, then you don’t have to be stressed about checking balance. Whenever funds are transferred, Chime sends notification alerts. Through these notifications you get transaction details as well as details of balance left.

Checking Chime balance through Chime Bank Statement

You can also get Chime Bank Statement for all the details of the transactions made with your Chime account. You can simply log in to your Chime app or website and apply for the bank statement. We have already mentioned above the steps of ‘How to get a bank statement through website or mobile phone.

Contact Chime Support

If in case you face any issues with the app, do not think twice to call the Chime support team. Support team at Chime will listen to your problems and will definitely assist or help you in every possible way.

What is Chime Bank Statement Template?

Chime bank statement is sent by a bank to account holders regularly. Bank statement assists all the account holders screen their bank exchanges. Not only this, Test bank statements count the exchanges from the date of your last exchange in your latest statement to the fulfilment of a particular timeframe.

It is a definitive technique for all the banks to give an outline of the multitude of exchanges that have unfolded. Also, it suggests to all the monetary exercises that whatever their customers have done month to month at that point to present this data altogether in a report. This statement usually starts with the basic equilibrium from the prior month and closures with the end equilibrium of the ongoing month.

Moreover, the statement incorporates a draft of the relative multitude of exchanges that occurred in a month or a particular period that you pick.

If you are a record holder, you need to consistently accommodate your bank statements when you get them as they would contain illegitimate exchanges. In this case, you have to directly inform your bank to modify these mistakes.

PDFSimpli does not approve any unlawful use of this software or in any way confirms the use of these forms for these purposes. This was made for novelty use, education purposes, as well as personal finance reconciliation practices.

Does Chime send Bank Statements?

Yes, Chime provide all its users with monthly paperless statements. You can get statements in your online account. For the same login to your Chime online account using credentials.

You can simply print or download your monthly statements through your online account. Directly click on ‘Statements’ and you can find previous calendar month there.

What if there is any Error in my Chime monthly statement?

Generally, checking account statements are contemplated to be correct. You need to review your statements properly and carefully and inform about the errors in 60 days.

Moreover , you have a privilege to acquire a 60 day history of your Checking Account transactions .

Further, you can contact Chime support for any assistance.

Wrap up !

We hope that this step-by-step instruct about Chime bank statement helped you. Once you are aware about bank statement and about it’s procedure ( how it works ), you can monitor your finances. Make sure to regularly analyze your bank statements, reports errors and much more.

Also Read:

- How To Get “Chime Direct Deposit” To Hit Early

- Chime Withdrawal Limit 2022-All You Need to Know

- Activate Your Chime Card: For the First Time Users (Guide)

- Chime Spot Me Helps You Save Money on Your Bills (2022 Guide)

FAQs

Bank statements are usually at hand to analyze monthly at the end of the billing cycle. If you wish to see bank statement before, you can use an ATM to view a mini statement. ( Mini statement is a brief version of a bank statement that generally describes the last 5 transactions on the account. Moreover, you can get the bank statement easily and quickly if you visit your branch or call them.

Normally, bank statements are displayed around the same day each month based on when your statement stops.

The statement sequence is generally 30 days and it doesn’t certainly have to be at the beginning to the end of the month, because it’s mostly decided whenever your account is opened.

Firstly, download the file on your PC.

After opening the file, give the print command.

For this, choose ‘file’ option and then select the print option.

You can easily find your Chime account and routing information in the ‘Move Money’ section. Secondly, you can find it under the ‘Settings’ section in your Android or iPhone app.